Contents

You should actively monitor the price chart for a trading opportunity when the price approaches these levels. Review the best professional Forex trading Robots, expert advisors , indicators, signal providers. Compare them according to their profitability and performance. In this article, we discussed the five major variations for the Pivot Point Indictor. They can be classified as Standard Pivot Points, Woodie’s Pivot Points, Camarilla Pivot Points, Fibonacci Pivot Points, and Demark Pivot Points.

On the other hand, if you have a bearish bias you can use the Camarilla pivot points to sell near the pre-calculated resistance levels. We introduce people to the world of currency trading, and provide educational content to help them learn how to become profitable traders. We’re also a community of traders that support each other on our daily trading journey. As a general rule, the areas that are farthest from the pivot point impose the highest hindrance to the price movement past them. Therefore, from the accuracy of the potential reversal zone identification standpoint, S3, S4, R3, and R4 are the most important levels. In this setup, the pivot point can be thought of as the baseline price around which the actual price wave oscillates.

Copy and paste the camarilla-pivot-points.mq4 indicator into the MQL4 indicators folder of the Metatrader 4 trading platform. On the chart, breakout levels for both long and short trades are being displayed with some text information for clarification. Note that the levels are calculated using data starting from the first visible bar, so study values might vary on different time periods. We will discuss Central Pivot Range in detail along with Camarilla Pivot Points to find right trade setup. Camarilla pivot points is a mt4 indicator and it can be used with any forex trading systems / strategies for additional confirmation of trading entries or exits. Furthermore, the the Indicator for MT4 suits all sorts of timeframe charts.

Do professional traders use pivot points?

Also, you can apply it for forex instruments and stock trading. That’s the reason why we prefer trading breakouts of the Camarilla pivot points. However, in order to confirm our breakout trade, we’re going to throw in another indicator. Because it’s based on volatility, the Camarilla pivot points will help filter out the current market condition. And secondly, under those conditions, it gives you a potential market range of high and low within which the market can trade.

This Camarilla indicator is a bit different from a regular indicator. For example, as you can see in the above image, the pivot value is also displayed in the upper left corner. In addition, this pivot indicator only displays R3, S3 and R4, S4. This allows you to focus only on the pivot points that are really important. Close to typical pivot points, it utilizes the last day’s excessive price, cheap price, and shutting price.

Paul Tudor Jones, one of the most successful hedge fund managers, was one of the biggest floor traders in the 80s. This Camarilla pivot trading strategy only uses the power of divergence along with the pivot points. What we like about this differentiation python calculator is the fact that it comes with an extra two levels of resistance and two extra levels of support . Pivot points, or simply pivots, establish areas of support and resistance by examining the highs, lows, and…

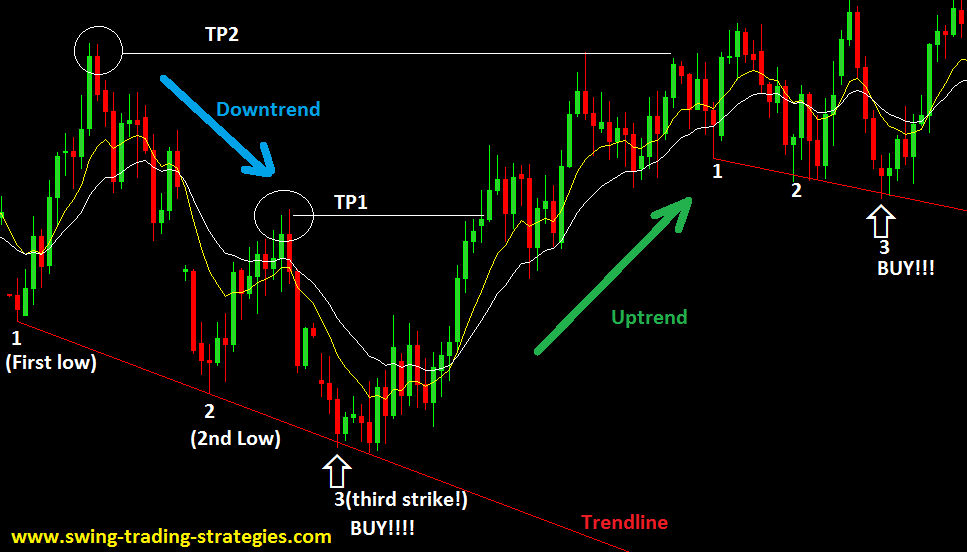

The mean reversion involves trading with the aim of the price trading back to the mean or average. In the case of the Camarilla trading strategy, we aim for a reverse back to the previous day closing price. Traders have also used this indicator to determine the trend, which helps them save time and money when deciding which stock to follow.

Pivot Points can be combined with other technical factors to create a confluent trading setup. For example, let’s say that you plot a bullish trend line using the 30 minute chart. Also, you have added the Standard Daily Pivot point study on your chart.

Boom and Crash Spike Detector Indicator for MT5

By incorporating the Daily, Weekly, and Monthly pivots, you would look for tight clusters. These areas are likely to be closely watched by many traders, and can provide for opportune mean reverting trade setups in many cases. Level of support or resistance is hit the potential for a breakout may be increased. And if this is the case, those traders would want to contain the damage of incorrect trades if these levels get hit on losing positions, looking to place stops just outside of these prices.

Our exit on the trade will the next higher pivot point level in case of a long trade, and the next lower pivot point level in case of a short trade. These pivot points have a conditional nature based on the relationship between the opening price and the closing price. Demark uses the number X to compute the upper resistance level and the lower support line. As you can see, we have a total of 4 Resistance levels, and a total of 4 Support Levels.

Checking your browser before accessing www forexfactory.com.

Combining Camarilla Pivot Points with the reversal candlestick patterns works perfectly when you’re dealing with continuous divergence on the price chart. Thus, adding divergence to the pivot points and candlestick pattern duo further helps improve the reliability of reversal trade signals generated by this setup. Camarilla pivots are a price analysis tool that generates potential support and resistance levels by multiplying the prior range then adding or subtracting it from the close.

Once we have these conditions met, then we will enter into the trade on the close of a strong reversal candle. As we have touched on in the prior section, it is important to combine Pivot Points with other technical studies in order to create a high confidence trade setup. In this section, we will take a look at a Pivot Point trading strategy that incorporates the Daily Standard Pivot Point Indicator, 150 Period Moving average, and Fibonacci retracement levels. Towards the end of the price action on this chart, you will see that price was moving down, and hit the horizontal price support and the overlapping S1 level support. In addition to that, as soon as price converged on this level, we saw a nice hammer candle with a long lower wick. After the reversal candle formed, priced bounced out of this area and shot up above the Pivot level and almost reached the R1 level within a short span of time.

Camarilla pivot point formula is the refined form of existing classic pivot point formula. The Camarilla method was developed by Nick Stott who was a very successful bond trader. What makes it better is the use of Fibonacci numbers in calculation of levels. Camarilla equations are used to calculate intraday support and resistance levels using the previous… Apart from the standard pivot points, the Camarilla points are a more advanced and versatile version of pivot points. If you want to discover what are the hidden support and resistance levels for the upcoming day trading session the Camarilla pivot indicator can help you out.

Execute and Manage Trade

So i was wondering if someone could create the Camarilla Pivot script for TOS as well? This pivot is calculated the same way as Woodie but the main difference is that it calculates for 8 main levels tokenexus compared to only 6 levels in Woodie. Trend Following System’s goal is to share as many Forex trading systems, strategies as possible to the retail traders so that you can make real money.

These pivot points effort for all dealers and assist them in selecting the good stop loss and gain purpose orders. The following illustration will show 2 reversals taking place within the same day on AUDUSD. Spreads, Straddles, and other multiple-leg option orders placed online will incur $0.65 fees per contract on each leg.

ZigZag WS Channel R v2 Indicator

Conversely, aim for a sell order when the price rejects the H1-H4 levels and plots a bearish candlestick pattern. I remember that at the time I was smugly sure that this was so, and was excited to be joining (as I then thought!) this secret ‘cabal’. Of course, as I learned more about the markets, I realized that this was nonsense, and that the markets are far too big to be effectively controlled, even by gigantic financial corporations. The word ‘Camarilla’ is based on the Latin word for room , and it means basically a small clique of ‘advisers’ who try to manipulate the person in power for their own ends.

Many intraday traders utilize the Camarilla levels to fade price moves when then reach the R3 or S3 level. Camarilla Pivot Points were invented by Nick Scott in the late 1980’s. They are similar in concept to Woodie’s in that they use the prior day’s closing price and range to compute the levels. This might sound a bit confusing at first, but essentially it works similar to an Exponential Moving Average, where the latter data is weighted more heavily than the earlier data.

The standard pivot points are derived from a mathematical formula that uses the average of the high, low, and closing prices from the previous trading day. From there is an additional math formula used that gives us 2 future resistance and support levels. Japanese Candlestick Patterns, beyond doubt, are among the most powerful analysis tools that technical analysis has to offer. Camarilla Pivot Points, developed by Nick Scott, are an improvement on the classic pivot point formula, and rely on Fibonacci numbers to calculate various support and resistance levels. In total, these points indicate nine price levels that traders leverage to identify potential reversal zones.

When you’re looking at a daily chart, you’re right that it doesn’t include pre/post. Use the bubblemover setting to put the labels/bubbles where you want them on the chart. Before putting it on site just see that how is the visibility of candles/charts. First we must see the charts then comes pivots etc. not easy for everybody to change it better change it with good quality visibility of candles that is the request. The plus500 web Indicator demonstrates eight horizontal levels. The L1, L2, L3, and L4 levels are plotted based on the recent market lows that work as support lines.

For bullish breakouts buy once we break and close above the R4. A stop order is an order placed to either buy above the market or sell below the market at a certain… Trading the Camarilla Pivot Points is done on the basis of open price on the next day . Learn how to trade forex in a fun and easy-to-understand format.

The chart above shows five days of activity for the EUR/USD pair using the 15 minute time series. The standard pivot point indicator is also plotted on the chart. You will notice the Resistance levels marked in green, the Support levels marked in Red, and the Pivot levels marked in black. Notice how many of these areas saw reactions as price approached the levels.

Finally, you would either add the result to the pivot point to calculate the Resistance levels, and you would subtract the result from the pivot point to compute the Support levels. But instead of 2 Resistance levels, and 2 Support levels, the Camarilla equation calls for 4 resistance levels and 4 support levels. Add to that the Pivot Point level, and there are a total of 9 levels plotted for Camarilla.

Futures, futures options, and forex trading services provided by Charles Schwab Futures & Forex LLC. Trading privileges subject to review and approval. Forex accounts are not available to residents of Ohio or Arizona. Futures and futures options trading involves substantial risk and is not suitable for all investors.